Divergence and Discipline

As we turn the page into 2026, markets are sending a clear message: this will be a year defined less by broad rallies and more by selective opportunities.

Global equities are beginning to diverge, precious metals are recalibrating after a strong run, and Indian markets are consolidating near record levels. This is driven by earnings, not liquidity, taking the centre stage.

Against this backdrop, disciplined asset allocation, diversification, and thoughtful capital deployment become more critical than ever.

In this edition, we unpack the signals shaping the year ahead! From silver’s evolving role in portfolios to where smart capital is quietly positioning itself. Let's begin.

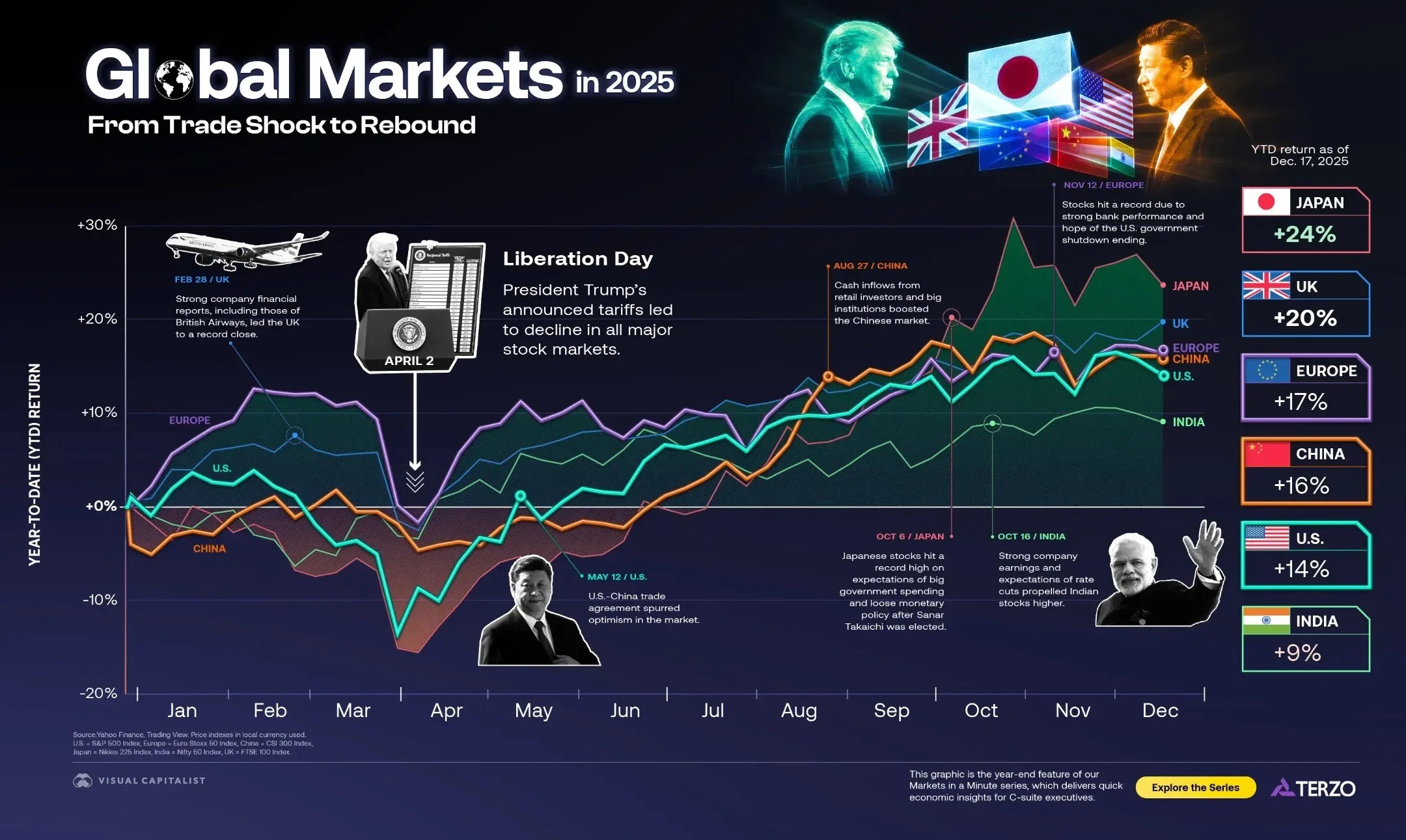

Chart of the Week: Global Markets Enter Divergent Paths

Insight: The past year highlighted sharply divergent global growth, shaped by major geopolitical shifts and economic policy changes. Markets were rattled in the first half by President Trump’s inauguration and sweeping trade tariffs, before rebounding after April’s “Liberation Day,” led by resilient U.S. earnings despite ongoing AI valuation concerns. Japan stood out on the back of looser fiscal policy as well as corporate governance reforms under the Takaichi government. Indian markets staged a modest recovery late in the year on rate-cut expectations and improving earnings.

As we move into 2026, increasingly divergent global growth reinforces the importance of diversification, active asset allocation, and ongoing fund monitoring.

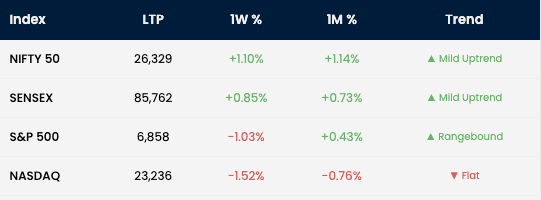

Market Watch

Indian equity benchmarks continued to show modest strength, with the NIFTY 50 and Sensex posting steady weekly and monthly gains, reinforcing a mild uptrend driven by selective buying and earnings support.

In contrast, U.S. markets remained mixed, as the S&P 500 stayed rangebound despite marginal monthly gains, while the NASDAQ underperformed on both weekly and monthly bases, reflecting pressure on growth and technology stocks. Overall, the data highlights a divergence between relatively resilient domestic markets and cautious global risk sentiment.

(As of week 26th Dec 2025 - 2nd Jan 2026)

*Sources : Investing.com, Moneycontrol

Broad Market View

Markets Seek Direction: Over the past month, Indian equity benchmarks have shown mixed performance with modest overall gains but choppy intra-month movement. The Nifty 50 and Sensex have oscillated in a range near ~25,900–26,300, reflecting profit booking at higher levels and renewed buying interest at support zones. Recent trading saw markets finish modestly higher with auto shares leading gains on strong December sales data, while other sessions showed broad weakness across sectors.

Volatility was influenced by foreign institutional flows and end-of-year positioning. Broader mid-cap and small-cap indices stayed mixed, generally lagging large caps.

Commodity Corner

Commodities experienced a measured pullback over the week, led by softness across precious metals and energy. Gold and silver declined as prices consolidated after recent gains, reflecting profit-taking amid stable risk sentiment.

Crude oil also moved lower, pressured by demand concerns and ample supply expectations, while copper edged down modestly, signalling a pause in industrial momentum. Overall, the commodity complex appears to be recalibrating, with prices adjusting rather than signalling a breakdown in underlying trends.

Theme of the Week: Silver — The Most Misunderstood Asset

As we move through FY2025, silver prices have outperformed gold, drawing renewed investor attention. Often seen as gold’s quieter cousin, silver sits at an unusual crossroads: part precious metal, part industrial commodity. Unlike gold, whose demand is driven largely by central banks and financial hedging, nearly 55–60% of global silver demand now comes from industrial applications like solar panels, EVs, electronics, and semiconductors.

This makes silver uniquely sensitive to both economic cycles and energy transitions. While demand is rising structurally, supply growth remains constrained, as most silver is produced as a by-product of mining for other metals like copper and zinc. This limits the industry’s ability to respond quickly to price spikes.

For investors, this dual nature creates opportunity and volatility. Silver tends to outperform gold during periods of economic expansion and rising risk appetite but it also corrects more sharply when growth expectations falter.

Deals Under Watch

CoreEL Technologies: Defence tech firm raised $30 Mn in a Series B round from ValueQuest Scale Fund and 360 ONE Asset Management.

PowerUp Money: Fintech startup secured $12 Mn in Series A funding led by Peak XV Partners with participation from Accel and Blume Ventures.

Heads Up For Tails: Premium pet care and D2C consumer brand raised ~$25 Mn in a Series B round led by Verlinvest, reinforcing its position as a category leader.

Arya.ag: Agritech firm raises over $80 Mn in Series D from GEF Capital.

Inito: Femtech and diagnostics company raised $29 Mn in a Series B round led by Bertelsmann India Investments, signaling growing institutional interest in healthcare IP-led plays.

*Sources : Inc42, YourStory, EnTrackr, MoneyControl

Expert's Opinion

Q&A with Neelesh Surana, CIO at Mirae Asset Investment Managers

Q: Is your view constructive on mid and small caps despite expensive valuations?

Yes, we remain constructive, but I don’t think this debate between large, mid, and small caps can be looked at in a very broad-brush manner. You really have to go company by company and sector by sector, and also look at where valuations were even a year or two ago. Market cap by itself shouldn’t be the deciding factor while building a portfolio, and for that reason I wouldn’t agree with the view that all mid and small caps are expensive.

Also, it’s important to recognize how much the mid- and small-cap universe has changed over the last five years. The opportunity set has expanded meaningfully with a strong wave of IPOs and increasing formalization of the economy. We’ve seen close to 300 meaningful IPOs above a billion dollars in this period, which means several quality businesses and sector leaders now sit in the mid- and even small-cap space simply because of classification. That expansion gives investors enough room to find companies across sub-sectors that can deliver strong earnings growth and attractive long-term returns.

Q: Is a quality-and-valuation approach at a disadvantage in momentum-driven markets?

In the short term, markets can often be driven by narratives and momentum, but those don’t really sustain over longer periods. Over time, a quality-at-a-reasonable-price approach is what has consistently worked across cycles and over decades.

If you are investing in high-quality businesses—those with strong longevity, sustainable growth, healthy returns on capital, and proven management—and you are careful not to overpay for that quality, the approach remains very effective. Ultimately, when valuations are sensible, returns tend to align with earnings growth over time, regardless of short-term market momentum.

*Source : Neelesh Surana in conversation with Value Research

Weekly Reading List

➤ Why Indian portfolios should allocate 10–30% to global assets in 2026

Discusses global diversification as a risk buffer and access point to AI, healthcare and clean energy.

➤ AI-driven inflation is 2026’s most overlooked risk, investors say

Global equities soared in 2025 on AI enthusiasm, but analysts warn AI-related inflation could force central banks to reverse cuts.

That’s all from us this week—thank you for your continued trust.

We view these insights as the start of a dialogue, not the end. If any of this week's themes sparked a thought you'd like to explore further, your wealth management partner is just a call away.